Biweekly mortgage calculator with taxes and insurance

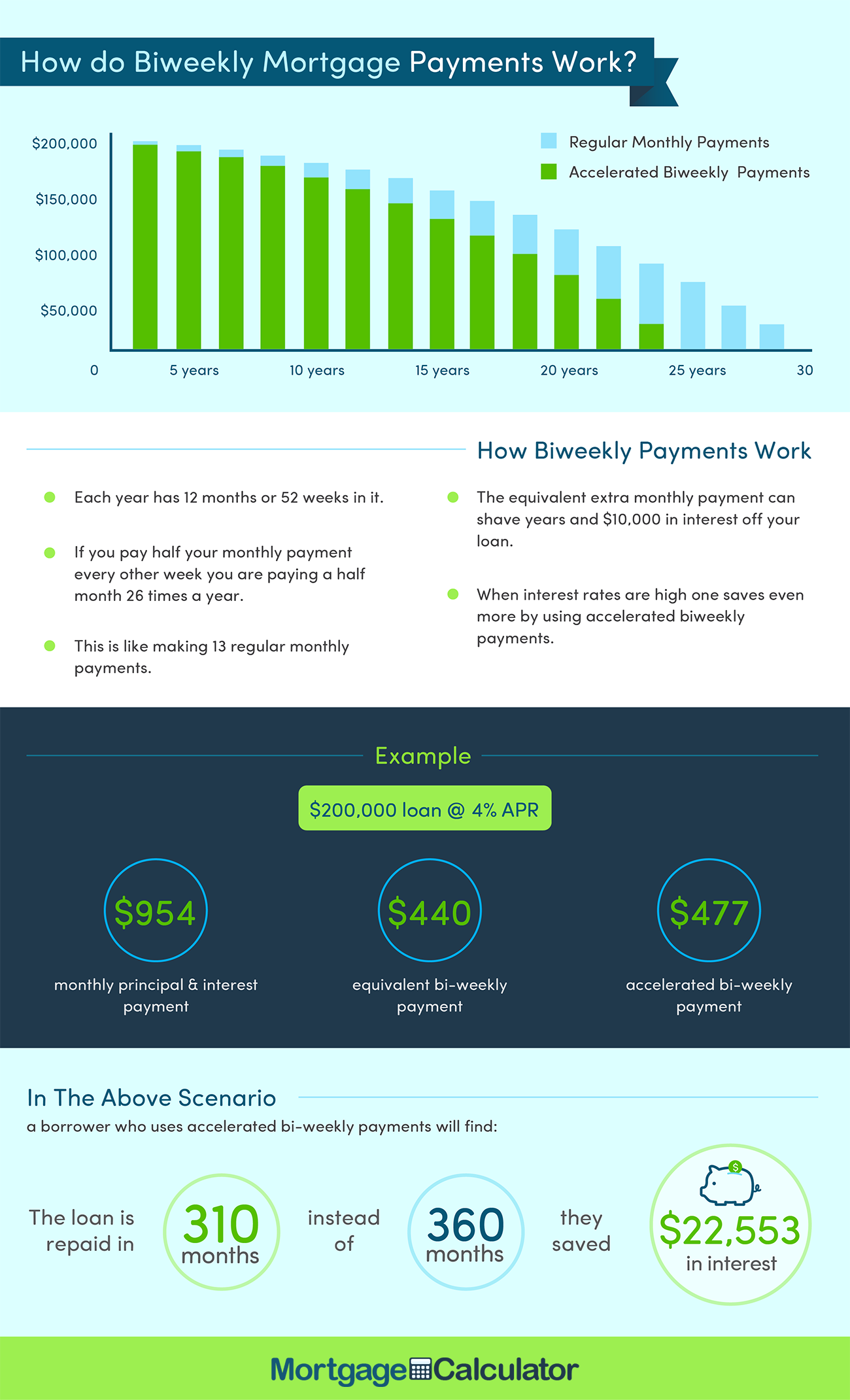

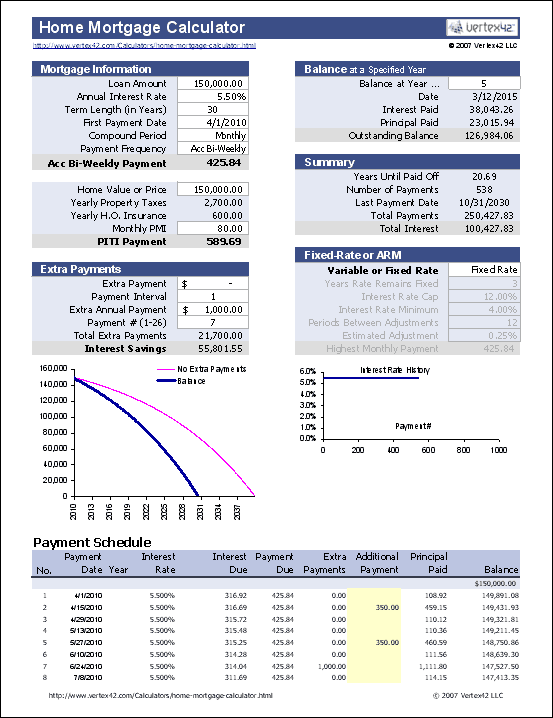

In the calculator the recurring costs are under the Include Options Below. With biweekly mortgage payments you make 26 half-payments a year which equates to 13 total payments in a year.

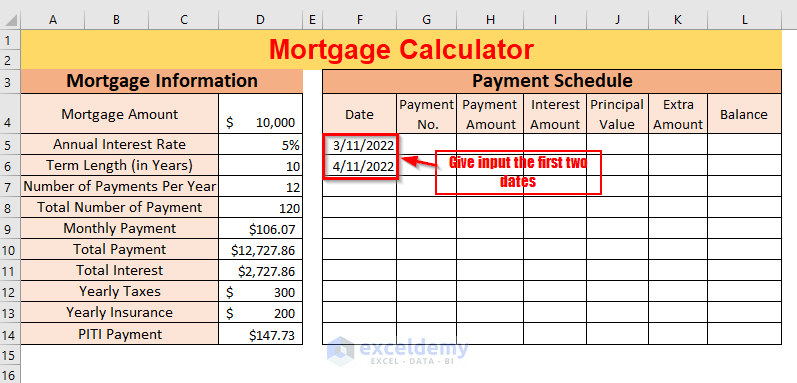

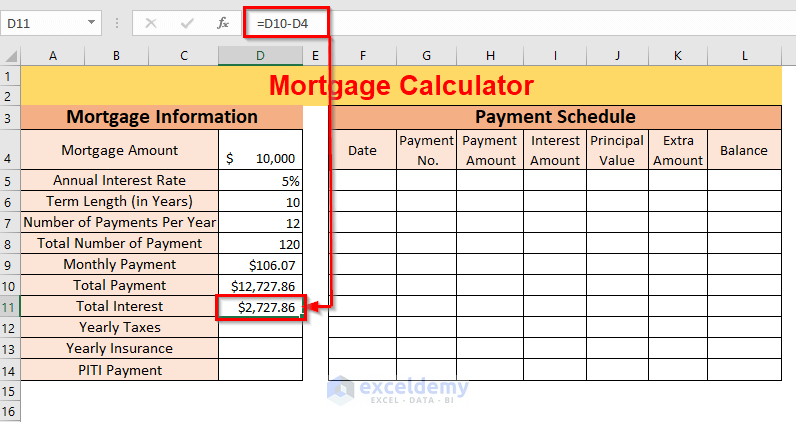

Creation Of A Mortgage Calculator With Taxes And Insurance In Excel

52 times per year.

. When you have a mortgage at some point you may decide to try and pay it off early. Use this biweekly mortgage calculator to compare a typical monthly payment schedule to an accelerated biweekly payment. Compare the monthly payment for different terms rates and loan amounts to figure out what you might be able to afford.

Then enter the loan term which defaults to 30 years. 365 times per year. The land mortgage calculator returns the payoff date total payment and total interest payment for your mortgage.

Use this calculator to determine your monthly. It can be a good option for those wanting to contribute more money toward a. Also offers loan performance graphs biweekly savings comparisons and easy to print amortization schedules.

In this calculator you can inclue investments annuities alimony government benefit payments in the other income sources. Using biweekly payments can accelerate your mortgage payoff and save you thousands in interest. A 20-year loan is 240 monthly payments A 15-year loan is 180 monthly payments a 10-year loan is 120-monthly payments and 5 year loan is 60 monthly payments.

It is possible to arrange biweekly payments which permit faster repayment and a lower loan cost. This is an added cost that protects lenders in case borrowers default on their mortgage. You may also enter 360 months for a 30-year loan or 15 years for a 15-year fixed or 180 months depending on loan type.

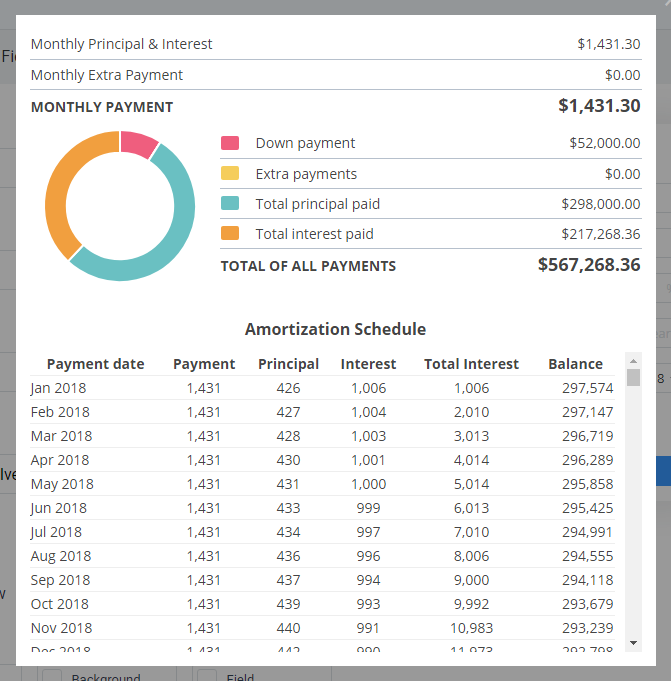

In just 4 simple steps this free mortgage calculator will show you your monthly mortgage payment and produce a complete payment-by-payment mortgage amortization schedule. Multiply your biweekly earnings by 10888 to convert them into semimonthly earnings. Adding Subtracting Time.

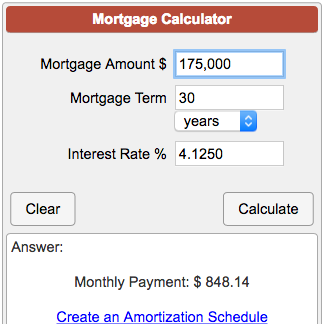

How to Use the Mortgage Calculator. Each year has 52 weeks in it which is equivalent to 26 biweekly pay periods. This includes driving for Uber or Lyft delivering food or groceries or selling goods online.

The HOA fee is included here if applicable. Mortgage calculator - calculate payments see amortization and compare loans. This results in 26 payments a year instead of 24.

If you work 2000 hours a year and make 50000 a year then you would drop the 4 zeros from the annual salary divide the result by 2 to get 25 per hour. You can also see the savings from prepaying your mortgage using 3 different methods. Property taxes home insurance HOA fees and other costs increase with time as a byproduct of inflation.

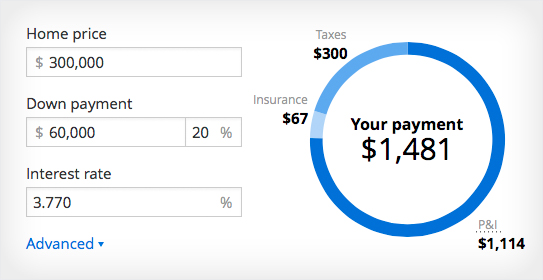

This free mortgage calculator helps you estimate your monthly payment with the principal and interest components property taxes PMI homeowners insurance and HOA fees. Free mortgage calculator to find monthly payment total home ownership cost and amortization schedule with options for taxes PMI HOA and early payoff. It protects the lender against some of losses.

Mortgage Calculator with Taxes and Insurance. Vacant Land Loan Calculator to calculate monthly mortgage payments with a land contract amortization schedule. Divide your annual salary by how many hours you work in a year.

The calculator divides your annual property taxes by 12 to calculate this monthly amount. This simple mortgage calculator was designed for making side-by-side comparisons of different monthly mortgage payments not including closing costs mortgage insurance or property taxes. 26 times per year.

One option to consider is a biweekly every two week payment plan. A mortgage allows the option of building up a cash account. Gig workers must pay federal income taxes and a 153 self-employment tax on earnings above 400.

You can change the payment frequency. Most home loans are structred as 30-year loans which is 360 monthy payments. Our calculator includes amoritization tables bi-weekly savings.

Biweekly Mortgage Calculator Mortgage calculator with PMI terms. 24 times per. To use the early payoff mortgage calculator simply enter your original loan amount when you first received the loan along with the date you took out the home loan.

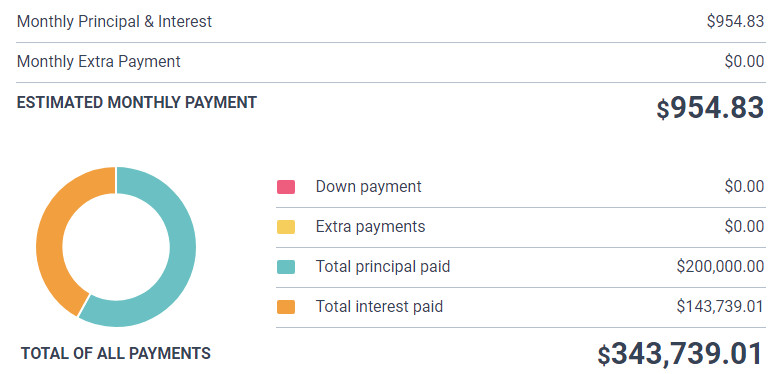

See how those payments break down over your loan term with our amortization calculator. If you make less than a 20 down payment the estimated monthly PMI. A biweekly payment means making a payment of one-half of the monthly payment every two weeks.

Are you starting biweekly payments in a middle of a loan schedule. This will be the only land payment calculator that you will ever need whether you want to calculate payments for residential or. Be sure to select the correct frequency for your payments to calculate the correct annual income.

It also calculates the sum total of all payments including one-time down payment total PITI amount and total HOA fees during the entire amortization. PMI is usually included into your monthly mortgage payments costing between 05 1 of your loan amount annually. Check out the webs best free mortgage calculator to save money on your home loan today.

These figures are exclusive of income tax. The outstanding principal balance of a mortgage is simply the total amount of money it would take to pay off the loan in full. Many employers give employees 2 weeks off between the year end holidays and a week of vacation during the summer.

The following table highlights the equivalent biweekly salary for 48-week 50-week 52-week work years. Mortgage Calculator with PMI Taxes Insurance and HOA biweekly. Conventional loans require private mortgage insurance if you make less than 20 down payment on the homes purchase price.

Your homeowners insurance premium is divided by 12 to calculate this monthly amount. It has many options that you may need such as PMI property tax home insurance monthly HOA fees and additional mortgage payment. Estimate your monthly payments with PMI taxes homeowners insurance HOA fees current loan rates more.

When a down payment is less than 20 percent home value the borrower must buy private mortgage insurance PMI. The monthly vs biweekly mortgage calculator will find out how much faster you can pay off your mortgage with biweekly payments and how much you will save in interest payments. The mortgage amortization schedule shows how much in principal and interest is paid over time.

How much this amount is depends on how much was originally borrowed how much has been paid down and what the annual interest rate is.

Bi Weekly Loan Calculator Biweekly Payment Savings Calculator

Top 10 Free Mortgage Calculator Widgets

Mortgage Calculator With Escrow Hotsell 56 Off Www Ingeniovirtual Com

Mortgage Calculator With Extra Payments Excel Hot Sale 57 Off Www Ingeniovirtual Com

Creation Of A Mortgage Calculator With Taxes And Insurance In Excel

How To Use A Mortgage Calculator Comparewise

Mortgage Loan Calculator Online 63 Off Www Oldtrianglecharlottetown Com

Mortgage Calculator With Pmi Mortgage Calculator

Cmhc Mortgage Calculator Factory Sale 55 Off Www Ingeniovirtual Com

Mortgage Calculator With Down Payment Dates And Points

Biweekly Mortgage Calculator

Mortgage Calculator With Pmi Mortgage Calculator

Mortgage Calculator With Taxes And Insurance

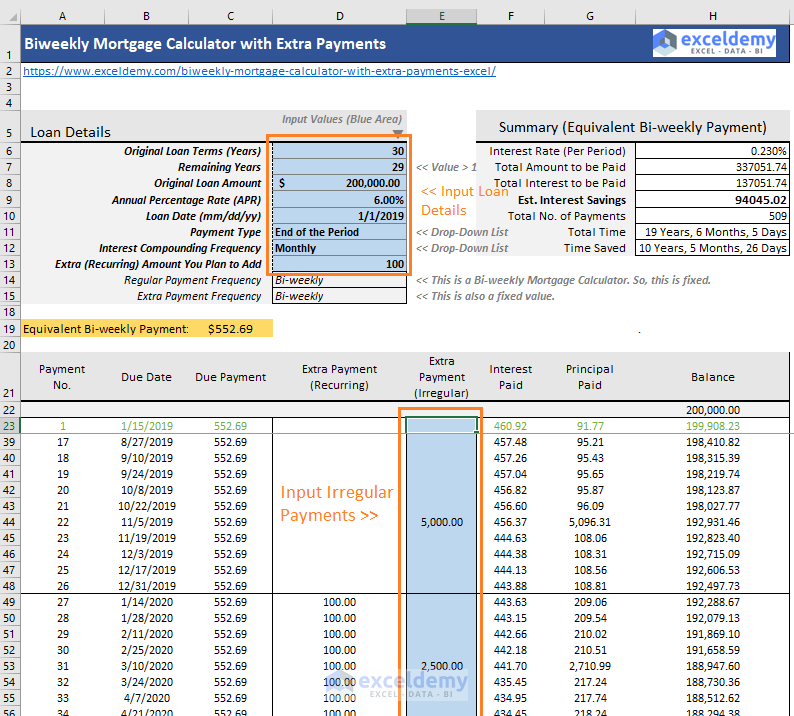

Biweekly Mortgage Calculator With Extra Payments Free Excel Template

Biweekly Mortgage Calculator With Extra Payments Free Excel Template

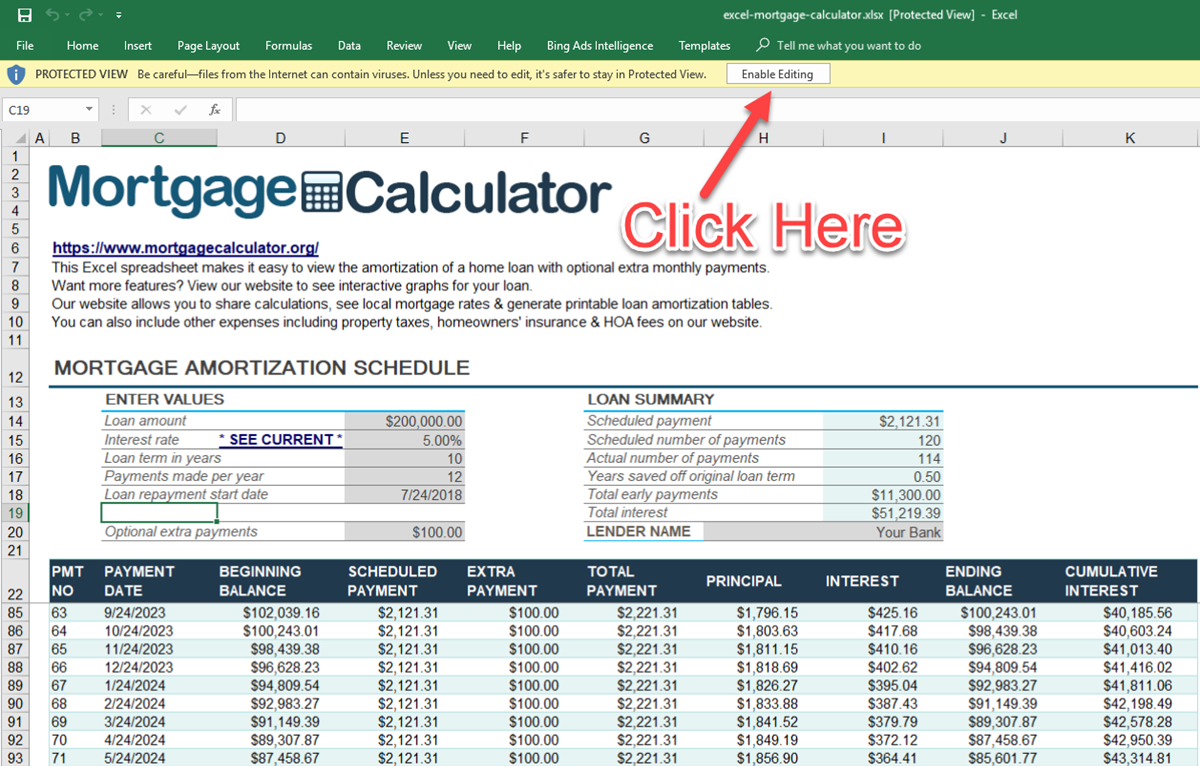

Download Microsoft Excel Mortgage Calculator Spreadsheet Xlsx Excel Loan Amortization Schedule Template With Extra Payments

Mortgage Calculator How Much Monthly Payments Will Cost